1. English language in China

China may be de-prioritising education requirements on the English language, but it’s not necessarily a bad thing.

Last month, the Shanghai Municipal Education Commission issued a notice on measures to reduce the burden of students and to enhance comprehensive all-round education (素质教育 rather than exam-oriented education 应试教育).

One of the measures is that students in Years 3-5 can only be tested on (Chinese) Literature and Mathematics in their final exams. For students in years 6-9, they can only be tested on (Chinese) Literature, Mathematics and Foreign Language in both mid-term and final exams (the other subjects can only be tested in the final exams).

The removal of English as a subject for final exams in Years 3-5 have attracted some attention in English-language media.

But we must remember that Foreign Language (English) remains a compulsory subject in primary schools, and one of the compulsory exam subjects in the National College Entrance Exam. So removing English from exams in Years 3-5 will not stop students from studying English anyway.

Yet there appears to be an expectation among English-speaking people and media that students in non-English speaking countries should prioritise studying English. And if the country starts to de-prioritise English in any way, then it’s a sign of regression, of decoupling from the world.

First, this is an alarmist perspective. Students will continue to learn English, simply because it is still examinable later on. But even if it’s not, most of them will continue to learn English, because it is still perceived as useful.

Second, this is an Anglo-centric perspective.

Let’s consider Australia. In NSW, foreign languages are not compulsory beyond Year 8. For the Higher School Certificate exam, the only compulsory subject is English. In fact, Australia is at the bottom of all OECD countries in terms of language study. Yet, there is very little concern that Australia has regressed and decoupled from the world. Most Australian or US leaders have never made a speech in another language, but somehow we should be concerned that Chinese leaders are not doing so in English anymore?

Now learning a second language (such as English or Chinese) is very useful. I highly recommend it to you all. If it was up to me, I would make studying a foreign language compulsory too. But it is a bit hypocritical for people from countries that don’t require foreign language study to be worried that another country is de-prioritising English.

2. Trade and tariffs

The Biden Administration is considering a new investigation into China’s industrial subsidies, according to Bloomberg.

During the Trump Administration, the US was focused on trade issues with China, with the US willing to trade off other issues (such as human rights in Xinjiang) to secure a trade deal. In January 2020, the US and China signed a trade deal, including commitments for China to purchase more US agricultural goods.

Now that China’s industrial subsidies and trade with the US may be back under the spotlight, here are few things to keep in mind:

- While the US is unhappy about China’s industrial subsidies, it is also increasingly using active industrial policies, including industrial subsidies.

- The Biden Administration is continuing with the protectionist trajectory. Although Biden has embraced more multilateral approaches, in trade it is still “America First”.

- Yet US industries and consumers are also suffering from the tariff — it’s not a cost imposed only on China.

- The US has not agreed to appoint new members to the WTO Appellate Body. The dispute resolution function of the WTO has fallen apart due to the repeated rejection of new appointments by the US. This means disputes on trade agreements cannot be adjudicated.

The US-China trade dispute has not been good for multilateralism or a “rules-based order”, with bilateral purchase agreements and tariffs imposed outside WTO mandate.

But it is the small countries, such as Australia, that will suffer/have suffered the most from the erosion of multilateral trading rules. While the two big players have the economic arsenals to fight each other, smaller economies do not. What smaller economies rely on is multilateral institutions such as the WTO.

A friend in need

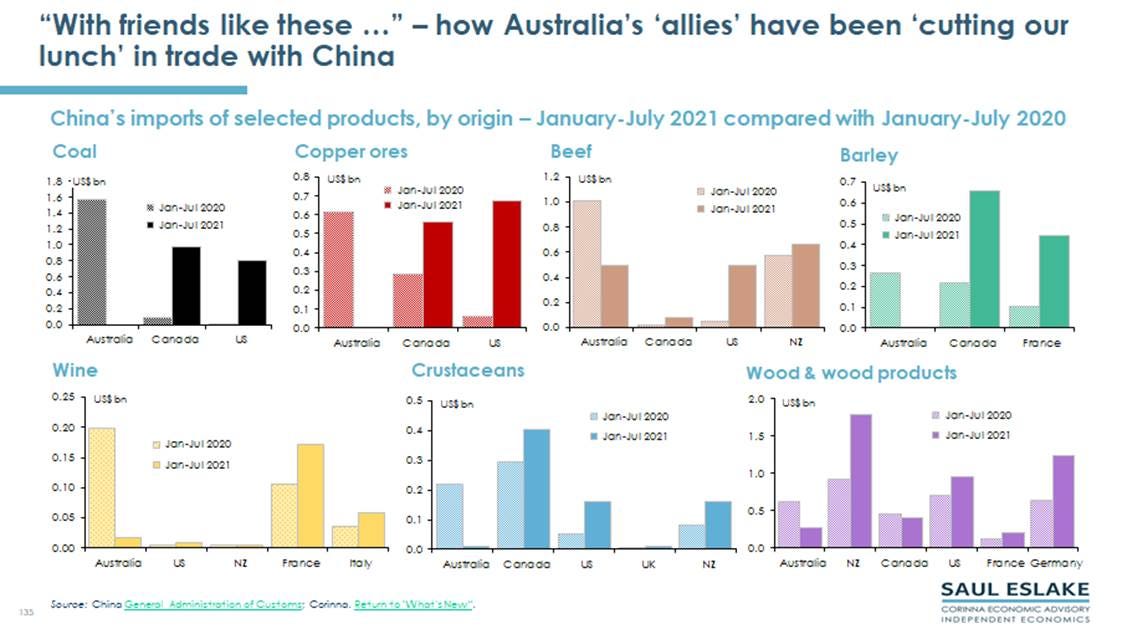

Saul Eslake from Corinna Economic Advisory produced the following charts on China’s imports:

The US and other Western countries have offered much rhetorical support to Australia as a victim of China’s trade actions. Yet as Australia’s coal, copper, barley and lobster exports are being decimated, they are happily picking up the slack. They’re benefitting from Australia’s loss while egging on Australia to stand firm.

Meanwhile, the United States Studies Centre (which is set up to strengthen the Australia-US relationship) has linked the alliance (security and defence dialogue) with trade.

This idea may actually be a good one if the US could be convinced to sacrifice its own economic and trade interests for other countries such as Australia. Or would Australia’s trade woes be another cost of the alliance, like the wars in the Middle East?

3. Evergrande

Evergrande (恒大集团), once China’s biggest developer, has a huge debt problem. It is facing $300 billion in debt and has started to pay bills with unfinished properties.

Retail investors of the company have gathered at the company office protesting against the company. Stock market-related protests are a common source of protests in urban cities.

Residential real estate is an industry that deeply affects all Chinese people living in cities. China has a high saving rate (partly due to the lack of social net) and much of the wealth is tied up in residential real estate. So real estate is an industry of high significance to social stability.

In recent years, the Chinese Government has focused on the issue of debt, but it remains to be seen whether it will let companies like Evergrande collapse, or whether it would be considered “too big to fail”. Letting companies collapse would send the right signal to the market to not rely on government bailouts. But a residential real estate company has so many stakeholders — both home buyers and investors — that it could affect social stability. So the government is unlikely to let the company suddenly collapse without any form of support.

Evergrande’s troubles may flow onto the residential real estate market in China. The government likely prefers the real estate market to cool gradually without sudden price changes. A cooler housing market will affect China’s imports such as iron ore.

4. China’s YouTube defenders

I don’t use YouTube much except to watch Physics lectures and Chinese dramas. But YouTube is also like the wild west, where everything from disinformation to propaganda can proliferate.

And unsurprisingly, there are many defenders of China’s government actions on YouTube, including those that deny any atrocities are committed in Xinjiang. Some have accused these YouTubers of being paid stooges of the CCP, but that’s not necessarily the case.

First, misinformation and disinformation proliferate on social media; many of these spreading messages are not motivated by pure and direct financial incentives. If people are willing to spread pro-Trump misinformation voluntarily, they may also do the same with pro-CCP misinformation.

Second, even if people are motivated by financial incentives, direct bribery is often unnecessary. As Yuen Yuen Ang points out in her book China’s Gilded Age, other practices such as “revolving door” can function in the same way as bribery. Some people may believe their actions can generate future benefits, including monetary, reputational or access benefits. Such incentives are what drives the military-industrial-think tank-government complex in many countries.