Space development planning of Xi’an High-tech Zone

Photo: Paul J. Farrelly

IN THE REALM OF technological innovation, China has arrived. China has launched manned space flights, constructed the world’s largest radio telescope, and sent the world’s first quantum-communications satellite into space, among other achievements in recent years. Its pursuit of ‘innovation-led development’ — including such schemes as the ‘Made in China 2025’ program (for more on this, see Chapter 2 ‘Talking (Up) Power’) and the Internet Plus initiative — promise more accomplishments to come. President Xi Jinping wants China to become one of the world’s most innovative countries by 2020 and a leading global science and technology power by 2049.

In 2018, however, China’s grand ambitions came face to face with dramatic changes in the outside world. In the US, the Trump administration spearheaded a series of higher tariffs and tighter technology controls, prompting former Treasury secretary Hank Paulson to warn of a looming ‘Economic Iron Curtain’ between the US and China. In Europe and Asia, other developed countries are taking a hard look at their collaborations with China as well. Whatever happens in the end with the US–China ‘trade war’, China’s relationships with the world’s traditional technology powers are clearly changing. China can no longer rely as heavily on engagement with the outside world to drive its technological development.

Rapid Ascent

To understand China’s rise as a technology power, first consider the country’s stunning increase in research and development (R&D) spending. In 2017, China’s total R&D spending reached an estimated 1.75 trillion yuan (US$445 billion in purchasing power parity terms) — a seventy per cent increase in the figure for 2012. China now stands as the second-largest investor in R&D worldwide, after the US, which spent an estimated US$538 billion in 2017. China invests 2.1 per cent of its GDP in R&D — more than many European countries but still short of the United States (2.7 per cent), Japan (3.3 per cent), and South Korea (4.2 per cent). Most of China’s R&D spending (78 per cent in 2017) comes from business — both state and privately owned.

China is also working hard to attract high-tech talent from overseas. In 2003, the Chinese Communist Party Politburo created the Central Coordinating Group on Talent (CCGT) 中央人才工作协调小组. In 2008, the CCGT launched the Thousand Talents Program 千人计划 and other initiatives to attract promising scientists, engineers, and entrepreneurs, particularly from within the Chinese diaspora, to work in China. By 2016, more than 6,000 individuals had registered to return under the Thousand Talents program — far in excess of the initial goal of 2,000 over ten years.

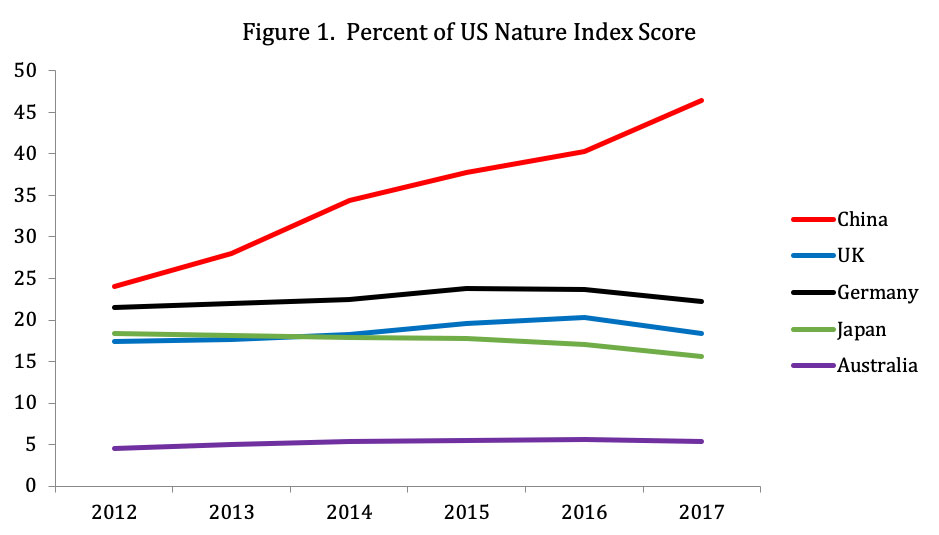

Figure 1: Per cent of US Nature Index Score

Source: Author’s calculations from Nature Index (https://www.natureindex.com). Note that the number of journals included in the index was increased from 68 to 82 in 2017.

This combination of money and talent is paying off. China’s meteoric rise in the world of scientific publishing is particularly impressive. To be sure, scientific journals have retracted an alarming number of articles by Chinese scientists in recent decades due to plagiarism, fraudulent research, and faked peer review. In 2017, for example, the journal Tumor Biology decided to retract 107 articles published by Chinese authors. More generally, however, China’s rise in basic science is quite impressive. The annually updated Nature Index records the institutional affiliations of scholars publishing in the most prestigious scientific journals around the world. US-based scientists continue to publish more articles in these journals than those of any other country, giving the US the highest score of any country in the index. Since 2012, however, China’s score has risen from twenty-four to forty-six per cent of the US score — a remarkable jump in just six years (see Figure 1 above). About half of China’s publications are in chemistry, but Chinese scientists are also publishing strongly in physical and life sciences as well. China’s top five institutions producing scientific research, according to the index, are the Chinese Academy of Sciences, Peking University, Tsinghua University, Nanjing University, and the University of Science and Technology of China.

Some Chinese firms have emerged as impressive high-tech players as well. The information and communication technology giant Huawei is among the world’s leaders in terms of total R&D spending, and it invests twenty to thirty per cent of its R&D spending in more ambitious ‘research and innovation’ projects. Two of China’s Internet companies — Tencent and Alibaba — now rank among the world’s top ten companies in terms of market capitalisation. More generally, Chinese Internet firms have proven more adept at integrating the online and offline worlds, compared with their US counterparts, partly because China leads the world in the adoption of mobile payment technology. Other Chinese firms have proven extremely adept at ‘efficiency-based’ innovation — improving product design, production processes, and supply-chain management to lower costs and reduce time to market.

China’s leaders are far from content with the progress to date. Launched in 2015, the ‘Made in China 2025’ (MIC2025) program aims to catapult China into next-generation manufacturing through the use of intelligent robots, wireless sensor networks, and integrated software processes. It prioritises ten high-tech sectors in particular:

- next generation information technology

- high-end computerised machines and robots

- space and aviation

- maritime equipment and high-tech ships

- advanced railway transportation equipment

- new energy and energy-saving vehicles

- electrical equipment

- agricultural machines

- new materials

- biopharmaceuticals and high-tech medical devices.

In 2017, China’s State Council launched a plan to make the country the ‘world’s primary artificial intelligence (AI) innovation centre’ by 2030. Towards this end, Baidu will focus on self-driving vehicles, Alibaba on smart cities, Tencent on health, and iFlytek on voice technology. For now, the US is still the world leader in AI: it has most of the world’s leading experts, specialised computing hardware, and a good supply of raw data on which algorithms can be trained. Yet China is a formidable challenger. Extensive government support, cutthroat domestic competition, and an astoundingly rich supply of data propel China’s AI sector. PricewaterhouseCoopers bullishly projects that AI will add US$15.7 trillion to the world economy by 2030, including US$7 trillion in China and US$3.7 trillion in North America.

China’s rising profile in science and technology could powerfully boost the country’s military capabilities over time. The People’s Liberation Army (PLA) collaborates with China’s universities and civilian firms in areas that range from robotics to cutting edge materials. This investment in ‘military-civil fusion’ 军民融合 has developed rapidly. By March 2016, China’s military was working with more than 1,000 civilian Chinese firms to develop and produce equipment for the armed forces. The AI race is seen as particularly important. The PLA now pursues not only ‘informatisation’ 信息化 but also ‘intelligentisation’ 智能化. This is evident in the military’s work on a range of AI applications, including in the fields of intelligent and autonomous unmanned systems; war-gaming, simulation, and training; data fusion, information processing, and intelligence analysis; and command and decision-making support.

Not So Fast

For all of China’s progress in recent years, a range of problems continue to hold the country back. The Chinese government is not shy about ‘picking winners’, for example, pressuring firms to focus on specific technologies and favouring some firms over others. Huawei aside, however, China’s state-favoured firms generally have a poor track record when it comes to technological upgrading, at least in information technology. With easy access to finance and the government procurement market, some of these firms hesitate to shoulder the costs and risks of cutting-edge innovation. And when they try, their inefficiency makes it difficult for them to succeed. The telecommunications company ZTE, for example, which was briefly banned from buying US technology by the US Department of Commerce in 2018, generally relies on the government procurement market to stay afloat. (For more information on ZTE, see Chapter 2 ‘Talking (Up) Power’.) Another example is the computer firm Lenovo. Founded by members of the Chinese Academy of Science’s Institute of Computing Technology, the firm has relied on acquisitions rather than its own internal capabilities to compete in global markets.

Chinese firms also tend to lag behind their foreign counterparts in generating revenue from new products. In 2016, foreign firms operating in China generated on average twenty-one per cent of their revenue from new products. Domestic firms generated only thirteen per cent. And while some of China’s leading technology firms have become large and prominent, China’s share of the world’s top one hundred companies (in terms of market capitalisation) barely changed between 2009 and 2018, rising from eleven to twelve per cent. US firms’ share in 2018 remained a remarkable fifty-four per cent.

China’s tightening political controls are also a problem for its science and technology sector. In recent years, censorship of ideas and resources, and closer policing of political attitudes among university faculty members have generated concern. At a meeting of China’s elite scientists in 2016, one stated that Internet controls were imposing ‘very great losses’ on Chinese science. Despite this and other expressions of concern, China’s leaders have continued to tighten their control over the Internet, including the banning of non-licensed virtual private networks in March 2018.

Information and communication technology giant Huawei is among the world’s leaders in terms of total R&D spending

Source: Kārlis Dambrāns, Flickr

On the positive side, in 2014 the government launched a much-needed effort to overhaul the national R&D funding system. Before that, the central government administered R&D funding through more than thirty different agencies, which supervised roughly one hundred different programs. The State Council announced that central government funding would be consolidated into five streams; these were all essentially in place by early 2017. Other reforms target the day-to-day challenges facing Chinese scientists, including regulations surrounding project management and opportunities to do part-time work for companies. Even so, the scientific community has not welcomed all the reforms. The State Council’s decision in 2018 to place the well-regarded National Natural Science Foundation of China under the supervision of the Ministry of Science Technology, for example, has generated concern that the former will enjoy less autonomy in funding decisions.

To be sure, one can point to China’s remarkable rise in the ‘Global Innovation Index’ as evidence that the country is doing well overall. By 2018, China ranked eighteenth in the index, not far behind South Korea (twelfth) and Japan (thirteenth). Nonetheless, purely quantitative measures can be misleading. China still struggles to translate innovation inputs into innovation outputs in an efficient way — something indices like this one can miss. In addition, while the number of patents granted within China has soared, the standards applied are lower than in developed countries. And while China-based inventors can point to an increasing number of patents in Europe and the United States as well, many of these belong to foreign multinationals that do R&D in China.

In short, China’s emergence as a techno-power is impressive in many regards, but the country continues to face a range of serious challenges. And a new challenge is now emerging: growing constraints on high-tech collaboration and commerce with other countries.

Peeved Partners

China’s rise as a high-tech power stems in many ways from its extensive cooperation with the outside world. While the number of Chinese students going abroad has increased markedly in recent years, the number returning has risen even faster: from thirty-one per cent of outbound students in 2007 to around eighty per cent today, with China’s booming tech industry an important attraction. Collaboration with foreign scientists has boomed as well: Chinese scientists and engineers published nearly 44,000 articles with US collaborators alone in 2016, eclipsing traditional US partners including the United Kingdom (25,858) and Germany (21,584). Foreign R&D centres in China are also making an important contribution. In Beijing, for example, Microsoft Research Asia has trained an estimated 5,000 Chinese AI researchers, including individuals who are now executives at leading Chinese Internet and tech firms including Baidu, Alibaba, Tencent, and Huawei. Some of China’s most successful firms, including Alibaba, have benefitted from extensive international financing. Chinese technology firms are themselves actively investing overseas, becoming important players in Silicon Valley and the like.

Despite the collaborations, cross-seeding, and partnerships, China’s high-tech policies and ambitions are now a source of serious tension with the developed world — particularly (but not only) the United States. The MIC2025 program has generated particular concern with its call for seventy per cent ‘self-sufficiency’ in core components and basic materials in priority high-tech sectors by 2025. This presents a clear challenge to traditional high-tech manufacturers including Japan, Germany, and South Korea. In the US, meanwhile, when the Office of the US Trade Representative released its report on China’s trade practices in March 2018, it mentioned MIC2025 an astounding 112 times. Trump’s first set of tariffs on Chinese exports, enacted shortly thereafter, targetted the sectors prioritised in MIC2025.

A number of developed countries have also started tightening restrictions on Chinese high-tech investments. In 2018, for example, the US Congress expanded the jurisdiction and funding of the Committee on Foreign Investment in the United States. In addition, new legislation requires executive agencies to identify and control undefined ‘emerging and foundational technologies’, which could constrain US investments overseas. In Europe, Germany has taken a tougher line on Chinese investments, particularly in high-tech sectors, after a Chinese appliance maker acquired the German robotics firm Kuka in 2016. With an eye on China, Germany and France are now pushing for tighter investment screening across the EU. Japan and the United Kingdom have tightened their screening processes as well.

Worries about Chinese industrial espionage are also part of the story. In 2015, the US and China agreed that neither government would ‘conduct or knowingly support cyber-enabled theft of intellectual property, including trade secrets or other confidential business information, with the intent of providing competitive advantages to companies or commercial sectors’. The G20 subsequently endorsed this prohibition on commercial espionage, which was reflected in other bilateral agreements with China. China’s cyber-enabled theft of IP appeared to decline for a period of time, although military reforms and anti-corruption efforts likely played a part in this as well. In 2018, however, there was increasing evidence that China was flouting these agreements, providing added justification for the Trump administration’s tariffs on Chinese exports.

Chinese students in some high-tech fields in the US have faced visa restrictions in 2018

Source: Rutgers Newark, Flickr

Worries about industrial espionage, and technology transfer more generally, are also chilling academic exchanges between China and the outside world. In February 2018, FBI Director Christopher Wray said Chinese espionage posed a ‘whole-of-society threat’ and that ‘non-traditional collectors’ of intelligence, including professors, scientists, and students, were exploiting the open environment at US universities. The Trump administration subsequently considered banning all Chinese students from US universities. Thus far it has only taken more limited measures, such as shortening the duration of visas for Chinese students in some high-tech fields. In Australia, meanwhile, Defence officials have proposed an expansion of technology controls at universities, prompting a swift backlash from the higher education sector.

China, of course, is capable of hitting back. China has responded to US tariff increases in 2018 with its own measures. It could also go further and treat the subsidiaries of leading US technology firms in China more roughly than it has so far, though this could play into the hands of those in the US government who favour economic ‘decoupling’ with China. China has also drafted its own export control law, which authorises retaliatory measures against any country that subjects China to discriminatory export control measures.

It remains unclear what the impact of these various tensions and measures will be. China has already built up considerable momentum in its quest to become a powerhouse of innovation. The US, meanwhile, has bungled its pressure campaign by acting unilaterally rather than in concert with allies that share many of its concerns. More generally, the Trump administration’s apparent interest in decoupling with China, particularly by uprooting high-tech supply chains, will require sustained effort and collaboration with other countries. But it remains to be seen whether this will materialise.

What is clear is that China can no longer count on the level of international exchange and collaboration it has enjoyed in the technology sphere in the past. China’s rise as a techno-power will continue, but Beijing could well find it a lonelier ascent in the future.

Notes

Enda Curran, ‘Paulson Warns of “Economic Iron Curtain” Between U.S., China’, Bloomberg, 7 November 2018, online at: https://www.bloomberg.com/news/articles/2018-11-07/paulson-warns-of-economic-iron-curtain-between-u-s-china

‘Forecast Gross Expenditures on R&D,’ R&D Magazine, Winter 2018, p.5.

National Science Foundation, Science and Engineering Indicators 2018, Arlington, VA: National Science Foundation, 2018, Chapter 4, p.39.

‘China’s R&D Spending Up 11.6% in 2017’, The China Daily, 13 February 2018, online at: http://www.chinadaily.com.cn/a/201802/13/WS5a827ffea3106e7dcc13c829.html

‘Qianren Jihua Jieshao [An Introduction to the 1000 Talent Plan]’, Qianren Jihua Wang [Thousand Talent Plan Network], 5 January 2017, online at: http://www.1000plan.org/qrjh/section/2

Lei Lei and Zhang Ying, ‘Lack of Improvement in Scientific Integrity: An Analysis of WoS Retractions by Chinese Researchers (1997–2016)’, Science and Engineering Ethics, 2017: 1–12.

Stephen Chen, ‘Science Journal Retracts 107 Research Papers by Chinese Authors’, South China Morning Post, 23 April 2017, online at: http://www.scmp.com/news/china/society/article/2089973/science-journal-retracts-107-research-papers-chinese-authors

‘AI to Drive GDP Gains of $15.7 Trillion with Productivity, Personalisation Improvements’, PwC, 27 June 2017, online at: https://press.pwc.com/News-releases/ai-to-drive-gdp-gains-of–15.7-trillion-with-productivity–personalisation-improvements/s/3cc702e4-9cac-4a17-85b9-71769fba82a6

Greg Levesque and Mark Stokes, Blurred Lines: Military-Civil Fusion and the “Going Out” of China’s Defense Industry, Pointe Bello, 2016.

Elsa B. Kania, ‘Battlefield Singularity: Artificial Intelligence, Military Revolution, and China’s Future Military Power,’ Center for a New American Security, November 2017, online at: https://www.cnas.org/publications/reports/battlefield-singularity-artificial-intelligencemilitary-revolution-and-chinas-future-military-power

Douglas B. Fuller, Paper Tigers, Hidden Dragons: Firms and the Political Economy of China’s Technological Development, Oxford: Oxford University Press, 2016.

He Yingchun, ‘Nankai President: Ideological Work Cannot Go to Another Extreme’ 南开校长:意 识形态工作不能走到另外一个极端, People’s Daily, 9 February 2015, online at: http://edu.people.com.cn/n/2015/0209/c1006-26532151.html

Ni Sijie, ‘Heated Discussion Among Academicians: Can Scientific Research Be Exempted from Internet Censorship’ 院士热议:科研网络监管能否“网开一面, Sina, 1 June 2016, online at: http://news.sina.com.cn/c/nd/2016-06-01/doc-ifxsqxxu4874793.shtml

‘CAS Academician: Moving NSFC to MOST Is a Mixed Blessing’ 中科院院士:国家自然科学基 金划到科技部喜忧参半, Caixin, 14 March 2018, online at: http://topics.caixin.com/2018-03-14/101221179.html

Lee Branstetter, Lee Guangwei, and Francisco Veloso, ‘The Rise of International Coinvention,’ in Adam B. Jaffe and Benjamin F. Jones, eds. The Changing Frontier: Rethinking Science and Innovation Policy, Chicago: University of Chicago Press, 2015, pp.135–68.

Andrew B. Kennedy, The Conflicted Superpower: America’s Collaboration with China and India in Global Innovation, New York: Columbia University Press, 2018, pp.32–33.

Lee Kai-Fu, AI Superpowers: China, Silicon Valley, and the New World Order, Boston: Houghton Mifflin Harcourt, 2018, p.89.

Office of the Press Secretary, ‘FACT SHEET: President Xi Jinping’s State Visit to the United States,’ The White House, 25 September 2015, online at: https://www.whitehouse.gov/the-press-office/2015/09/25/fact-sheet-president-xi-jinpings-state-visit-united-states

Andrew B. Kennedy and Darren J. Lim, ‘The Innovation Imperative: Technology and US–China Rivalry in the Twenty-First Century,’ International Affairs 94, no.3 (2018): 553–572.

Adam Segal et al., ‘Hacking for Cash: Is China Still Stealing Western IP?’, Canberra: Australian Strategic Policy Institute, 24 September 2018, online at: http://apo.org.au/node/194141

Elizabeth Redden, ‘The Chinese Student Threat?,’ Inside Higher Ed, 15 February 2018, online at: https://www.insidehighered.com/news/2018/02/15/fbi-director-testifies-chinese-students-and-intelligence-threats