Some of the numbers that have been collected, concocted, analysed and debated in recent years illustrate the potentially serious nature of China’s economic, social and political challenges. Ongoing debates regarding fertility rates, the pending exhaustion of rural surplus labour, the end of the demographic dividend, gender imbalances, income inequality and government debt make it virtually impossible for anyone to predict particular outcomes with precision. Accurate assessments of China’s socio-economic outlook require more accurate collection and reporting of numbers. Meanwhile, great care must be taken in interpreting those that are available.

A propaganda poster (now known as a ‘public service announcement’) exhorts citizens to treat male and female children equally. Despite such campaigns, China has a sex ratio of 108 males to 100 females (UN World Population Prospects 2010).

Source: Imagine China

In April 2011, the International Monetary Fund hit the headlines in China and abroad with the announcement that China’s Gross Domestic Product (GDP), in purchasing power parity (PPP), would surpass America’s in 2016, making it the largest economy in the world. Already the world’s second largest economy, with an official rate of GDP growth returning to over ten percent in 2010 after only a slight slump in 2009, and with official estimates of foreign exchange reserves at over US$3 trillion in 2011, it seemed reasonable when Premier Wen Jiabao offered to help debt-ridden Europe at the World Economic Forum’s annual meeting in Dalian, China in September 2011. He said:

We have been concerned about the difficulties faced by the European economy for a long time, and we have repeated our willingness to extend a helping hand and increase our investment [there].

Yet the European Union’s per capita GDP in 2010 of US$32,537 was more than seven times that of China’s of US$4,382, with Europe’s (and the world’s) richest economy, Luxembourg, being fifty-five times richer in terms of GDP than China’s poorest province, Guizhou. China’s leaders already face growing international pressure to reform their exchange rate regime, capital markets, financial and banking sectors, and even their style of government. They also must deal with a daunting list of internal development and reform issues relating to the ageing of the population, income inequality, health care and social security, rebalancing the economy, environmental deterioration and poverty. It is clear that China’s leaders have their hands full with internal and external challenges alike.

The Sixth National Census

The results from the Chinese government’s Sixth National Census in 2010 were released in April 2011, followed by a surge of media commentary and academic analysis. The demographers Zhongwei Zhao and Wei Chen noted that the 2010 Census recorded a number very close to that revealed by annual population survey data for 2009, which they take as an indication that the census data is in fact quite accurate. They also note that the United Nation’s population projections for China for 0-14 year olds in 2010 were thirty-eight million higher than the census results, projections that were based on total fertility rates (TFR) of 1.8, 1.7 and 1.64 children per woman for the periods 1995-2000, 2000-2005 and 2005-2010 respectively. These two pieces of information, alongside a few others, enabled them to calculate the fertility rates that would have resulted in the true Census population results for 2010, which they put at 1.6, 1.45 and 1.45 for the same three periods above. This leads them to conclude that China’s fertility rate is considerably lower than the officially reported level, and has been since the mid-1990s.

One cannot help but wonder why the National Population and Family Planning Commission (NPFPC) would consistently report a TFR that hovered so closely to 1.8. Indeed, the official TFR was a flat 1.8 from 1999 to 2005, and it was within two hundredths of 1.8 since 1994 (fluctating between 1.82 and 1.78). Given the vast number of factors that determine fertility rates – including the level and pace of economic development, urbanisation, female education, increases in labour force participation rates, improved life-expectancy of new-born children, costs of a competitive education system, and family planning policies and their efficacy – it seems improbable that China’s TFR would have maintained such stability over such a dynamic time period. Zhao and Chen suggest that the ‘selection’ of this number ‘seems not to be an arbitrary or anecdotal action’, but a matter of convenience. For example, being just under the replacement level (of 2.1, the fertility rate required to maintain a constant population), it can create the illusion of having achieved the desired objective of slow and steady population reduction without greatly affecting the overall age structure of the society. Moreover, it indicates that family planning policies have succeeded in bringing fertility rates down, and therefore deserve further funding and support.

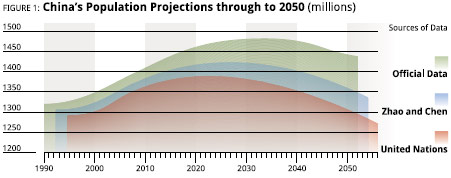

While this provides some logic for the actions of officials within the NPFPC, it does not justify their being allowed to get away with this misreporting over such a long time period. Figure 1 illustrates the projected populations based on official data (OD), data collected by the United Nations (UN) and Zhao and Chen’s (ZC) revised population figures. The differences between the most credible estimates (ZC) and the least believable (OD) of China’s total population reach 112 million for 2030 and 180 million by 2050. Zhongwei Zhao rightly concludes that: ‘Differences of nearly 20 percent in estimated fertility levels and of [over] 100 million people in projected population size are by no means negligible.’

Source: based on the range of sources described in the text.

For more information, see the Online Notes to this volume at: www.TheChinaStory.org

Accurate population and fertility data are crucial for understanding the economic implications of demographic change in China, as elsewhere. Has China’s demographic dividend already ended or does it have decades to play out? Just how rapidly is the population ageing? Is China really running out of ‘surplus labour’? And what should be done in response? Without accurate data, it is very difficult to say. Below I consider some of the economic implications of getting the population numbers wrong.

The Demographic Dividend

Will grandpa eat the demographic dividend? Economists worry that China will ‘get old before it gets rich’.

Source: Imagine China

There is a growing body of evidence to suggest that the potential demographic ‘dividend’, ‘gift’ or ‘bonus’ associated with a country’s demographic transition towards slower fertility and population growth, and therefore a growing share of the population engaged in – rather than depending on – the workforce, can be quite substantial. This issue was the focal point of the Asian Development Bank’s Asian Economic Outlook for 2011. Perhaps no country has benefited more from such a transition than China. According to some estimates, the change in the age structure of China’s population over the last two decades could explain fifteen to twenty-five percent of its record-breaking stretch of high economic growth.

Cai Fang, a member of the National People’s Congress Standing Committee and Director of the Institute of Population Studies at the Chinese Academy of Social Sciences, has written a string of papers on this topic, including a recent one entitled ‘The Coming Demographic Impact on China’s Growth: the age factor in the middle-income trap’. Cai emphasises that the economic benefits of China’s expanding workforce are rapidly coming to an end. This will reduce the advantages China enjoys in labour-intensive industries at a time when the workforce is ill-equipped to compete with developed economies in technology- and capital-intensive industries. As a result, China could fall into a ‘middle-income trap’, that is, failing to make the transition to high-income status. Finding ways out of this trap will be necessary to prevent China from ‘getting old before getting rich’, a situation in which it would face the challenges of an ageing society without the necessary reources.

Rod Tyers and I have studied the impact of demographic change on China’s economic performance using a global economic model that incorporates the age and gender structure of sixteen geographic regions, of which China is one. In projecting through to 2030, this kind of modelling work necessarily involves assumptions about how various demographic parameters will change over time – including birth rates, sex ratios at birth, age-gender specific death, immigration and emigration rates, life expectancies, and labour force participation rates. While agreeing with Cai Fang that most of China’s demographic dividend lies in the past, our work shows that, under alternative assumptions about fertility rates, it is not necessarily over. With the right policy decisions, it could plausibly last for at least another decade. An obvious criticism of our work would be that it relies on the United Nations Population Projections for China’s population data including on fertility rates, which, as shown above, may well be overstated.

The End of Surplus Labour?

A related debate, in which population figures matter, centres on China’s rural labour force and the extent to which it is ‘surplus’ to rural development, and hence available at low wages to fuel urban industrial development, particularly in the labour-intensive factories in south-east China, and in Guangdong. Following media reports of labour shortages in Guangdong from 2004, a number of academic studies have claimed that China is either close to, or has already reached, a turning point in economic development in which the supply of rural surplus labour has been exhausted, resulting in labour shortages and rising wages in the urban sector. A special issue of the China Economic Journal in 2010, published by the China Center for Economic Research at Peking University, was dedicated to this topic. It is also something that featured regularly in articles published in Caijing magazine and Chinese newspapers in 2011.

Yet there is also considerable empirical data showing that, despite some evidence of rising wages in urban areas, there is little to suggest that a labour supply shortage is the cause. Instead, because of policies that still hinder many rural workers from migrating to cities, Chinese industries may be denied access to millions of under-employed low-income rural labourers. This, combined with evidence of low migration rates and a high degree of ‘churning’ – migrants over their early twenties who return to their villages – immediately raises the question of why more rural workers are not migrating to urban areas. A thoughtful policy response would be to reduce the institutional barriers to cross-regional migration. Population projections through to 2020 based on the hypothesis that all barriers to migration were eliminated suggest that the number of migrants could more than double, from the current estimate of 150 million to around 300 million.

How do the results of the 2010 Population Census then feed into this debate? The 2010 Census reported that China had 940 million people between the ages of fifteen to fifty-nine (a group often referred to as the ‘working age population’). This is fairly close to the UN 2010 estimates of 915 million (a difference of about twenty-four million or three percent). However, the gap between these sources is much larger for children aged 0-14 – that is, China’s future workforce. The 2010 census reports this number as being 222 million compared with the UN’s 261 million, a gap of over thirty-eight million or fifteen percent.

At face value, it may be tempting to conclude that, as the Chinese population is lower than hitherto thought, the end of the country’s labour surplus must be nigh. But it is not that simple: we need to know how this reduction is distributed among various population groups. For example, if the thirty-eight million ‘missing children’ are all rural residents, then the labour surplus would come to an end more rapidly. However, if they are all urban, this will not necessarily be the case. The point is that accurate measures of the population, and its distribution across age and space, are crucially important for understanding China’s growth and future economic potential.

Urban and Rural Populations and Incomes

Data from China’s National Bureau of Statistics (NBS) released in January 2012 showed that there were more people living in cities than in the countryside for the first time in China’s history. Other statistics from 2011 released by NBS include:

- the number of urban dwellers increased by twenty-one million to hit 690.79 million at the end of 2011, accounting for 51.27 percent of the country’s total population. The rural population fell by 14.56 million to 656.56 million;

- China’s total population increased by 6.44 million during 2011 to 1.34 billion;

- the income gap between urban and rural residents narrowed. Urbanites’ average income was 3.13 times of that of rural people, down from 3.23 in 2010 and 3.33 in 2009. Rural residents’ per capita income rose 17.9 percent year-on-year in 2011 to 6,977 yuan. Per capita disposable income of urbanites was 21,810 yuan, up 14.1 percent from one year earlier; and,

- the survey results showed that the per capita wage income of rural residents rose 21.9 percent to 2,963 yuan in 2011, with wages accounting for 42.5 percent of rural residents’ incomes. Media reports attribute the increase in rural residents’ wages to rising incomes of migrant workers. This is a change from the trend noted by the NBS in early 2010, described by China Daily in an article titled: ‘Urban-rural Income Gap Widest Since Reform’.

Sex Matters

Another important question is whether these ‘missing millions’ are male or female? According to the United Nation’s World Population Prospects (the 2010 Revision), China has a sex ratio of 108 males to 100 females, the highest gender imbalance of any country in the world.

An imbalanced sex ratio is a common demographic feature in many countries, especially in East, South and Southeast Asia, where a combination of cultural preferences for sons, the desire to reduce the size of families, and the introduction of Ultrasound B technology that can detect gender have resulted in a rise in sex-selective abortions in recent decades. With China’s one-child policy added to the mix, the results have been dramatic. According to one recent estimate, China’s sex ratio at birth was just 1.07 in 1980, only just above the natural rate of 1.06, rising to 1.12 in 1990, 1.18 in 2000 and reaching 1.22 in 2007. Assuming that the survey methods used in the cited studies are reliable, China currently has somewhere between thirty and forty million ‘missing women’ or ‘excess men’.

According to Columbia University’s Shang-jin Wei and his co-authors, Qingyuan Du and Xiaobo Zhang, this has resulted in ‘male excess savings’. According to this theory, in a population with a rising ratio of men to women, men try to out-save each other in order to be competitive in the marriage market. Wei and Zhang demonstrate that per this ‘competitive saving motive’, the rise in China’s sex ratio can explain half of the increase in Chinese household savings as a share of disposable income (from sixteen percent in 1990 to thirty percent in 2007).

Wei and Zhang take this idea further in their exploration of the sexual foundations of economic growth. They find support for the hypothesis that China’s sex ratio imbalance may stimulate economic growth through entrepreneurial activity and hard work – not because males are inherently more entrepreneurial, but because when the sex ratio is high they are more driven to increase wealth in order to be competitive in the marriage market. Their claim is supported by empirical evidence that men in regions with relatively high gender imbalances are more willing to accept dangerous and unpleasant jobs and work longer hours.

And it doesn’t stop there. Du and Wei show how China’s rising gender imbalance accounts for more than one half of the current account imbalance between China and the United States. They conclude that although China’s ‘sex ratio imbalance is not the sole reason for global imbalances, it could be one of the significant, and yet thus far unrecognised, factors.’ The high rate of savings helps to generate the vast pool of foreign exchange reserves that the People’s Bank of China invests overseas, primarily in the US, giving China global economic and political heft. According to William Overholt of Harvard University:

The recycling of China’s huge foreign exchange reserves was far from the only source of the tsunami of liquidity, but it was one of the largest. Chinese leaders have angrily denied that Chinese funds and inexpensive exports played this role, but ultimately it is a simple fact. Conversely, Western politicians have been far too quick to blame Chinese currency policies when the actual problem stemmed from the U.S. bubble demand, combined with high Chinese savings rates…

In combination, if one were to credit both the findings of Wei and his colleagues and Overholt’s analysis, an argument could be made that China’s rising sex imbalance was largely responsible for the global financial crisis!

Of course, such a conclusion relies on a range of some questionable numbers. The accuracy of the fertility rates quoted by Wei and Du are perhaps the least problematic. In their model of marriage and savings, both sexes maximise utility, something that is jointly determined by wealth and love. To set up the ‘love parameter’ for their calibrations, Wei and Du value a lasting marriage at US$100,000 per year (on top of one’s own income), which is about two times the average income per worker during the period 1972-1998. On this basis they set the mean of ‘love’ = 2! To attribute the global financial crisis to China’s gender imbalance on the basis of these assumptions would be going too far.

Economic models such as these earn economists a bad name. Yet as long as you don’t take the numerical results to be accurate forecasts (which they are not intended to be), such models provide a crucially important means for understanding dynamic and complex processes. China did not cause the global financial crisis. But there is some evidence to suggest that China’s rising gender imbalance helps explain that country’s high savings rates, from which global macroeconomic consequences follow. A deeper understanding of the impact of gender imbalances on the economy would require accurate measures of all sorts of things, including ‘valuations’ of love, and sex ratios at birth. While we cannot expect the Chinese (or any other) government to devote resources to measuring and reporting on the former, we can and should expect them to accurately measure and report the latter.

Top Ten Problems of Public Concern

In December 2011, the Chinese Academy of Social Sciences (CASS) published a list of the top ten problems of concern to citizens in China. It was based on a survey of 6,468 people over the age of eighteen, drawn from five major cities, one hundred counties and 480 villages across the country. Respondents were given a list of problems and asked which ones worried them. The percentage of respondents who expressed concern about each item is as below:

- Soaring commodity prices: 59.5 percent

- Health care availability and cost: 42.9 percent

- Income and wealth gap: 31.6 percent

- Governmental corruption: 29.3 percent

- Unemployment: 24.2 percent

- Housing prices: 24 percent

- Retirement pension for the elderly: 16.6 percent

- Food safety: 15.9 percent

- Education costs: 10.9 percent

- Environmental pollution: 10.3 percent

The Gini Coefficient and Bo Xilai

In January 2012, Caixin magazine reported:

For the eleventh year in a row, Chinese officials say they cannot publish the nation’s Gini coefficient – a common measure of income inequality used worldwide.

…The Gini coefficient, which measures income distribution on a scale of zero to one, indicates a relatively reasonable income gap if the number is between 0.3 and 0.4. A Gini index between 0.4 and 0.5, however, signals a large income gap.

The main reason [for not publishing China’s Gini coefficient], the National Bureau of Statistics (NBS) Director Ma Jiantang said on 17 January 2012 is that data on high-income groups is incomplete. Some experts criticized the announcement, saying the government is looking for reasons to de-emphasize China’s significant wealth gap…

…The last time Chinese officials published a Gini coefficient was in 2000, when they announced that China’s 2000 figure was 0.412. A 2011 NBS report said that the 2011 ‘Gini coefficient is a little bit higher than that in 2010’, but did not elucidate either year’s figures…

Other media reports noted that the week before Bo Xilai was ousted as Chongqing Party Secretary, he told reporters that China’s Gini coefficient had exceeded 0.46.

The Caixin report also highlighted the following:

- in its Twelfth Five-year Plan for 2011 to 2015, published before the fall of Bo Xilai, the Chongqing Municipal government committed to bringing down its Gini ratio from 0.42 to 0.35. This was the first time a local government had included Gini coefficient goals into its Five-year Plan.

- according to a 2007 China Reform Foundation report, 4.4 trillion yuan in ‘grey income’, or undeclared income, of urban residents had not been accounted for in official statistics, amounting to twentyfour percent of China’s total GDP.

An Harmonious Society?

The misreporting of population and fertility data is not an imminent threat to China’s economic stability. However, in recent years there has been growing concern that the misreporting and/or poor measurement of its economic data might be.

The economist Nouriel Roubini became famous for having predicted a ‘catastrophic’ global financial meltdown that central bankers would be unable to prevent in July 2006. In 2011, he and Dani Rodrik were two of the more pessimistic commentators on the Chinese economy. Writing in The Financial Times on 23 August 2011, Dani Rodrik pointed out that other predictions for the Chinese economy are ‘largely extrapolations from the recent past and they overlook serious structural constraints’, most critical of which is to reorient the economy ‘away from export-oriented manufacturing and towards domestic sources of demand, while managing the job losses and social unrest this restructuring is likely to generate.’

In 2011, Roubini discussed the possibility of a ‘perfect storm’ that could again threaten the global economy, with China’s role in this storm related to its overreliance on exports and fixed investment: ‘Down the line [in China], you are going to have two problems: a massive non-performing loan problem in the banking system and a massive amount of overcapacity [that] is going to lead to a hard landing.’

For China’s sake, and that of the rest of the world, it would be nice if Roubini turned out to be wrong this time around. Unfortunately, it doesn’t really make sense to look to China’s official statistics to convince oneself that he will be, as the Chinese leadership itself seems willing to admit. In early 2011, Derek Scissors, an economist at the Heritage Foundation in the United States, concluded that it was not credible that the Chinese economy was growing at an annual ten percent, as it was officially claimed. Scissors starts with the admission in late 2010 by Li Keqiang (set to become China’s premier in 2012) that China’s official GDP figures were ‘for reference only’. Li was also quoted as saying that bank lending, rail cargo and electricity consumption were the best indicators of ‘the true health of the Chinese economy’. Scissors uses this ‘Li Keqiang theory’ to argue that China’s actual economic performance was stronger than officially reported in 2010 and weaker in 2008-2009. Differing from the common view that Chinese economic data is universally over-reported, Scissors suggests that a more ‘nuanced view is that the Party is obsessed with stability, and this obsession leaks into data reporting such that the highs and lows of China’s economic performance are both dampened.’

Rich and Poor

In 2008, the World Bank reported that 29.8 percent of China’s population was living on less than US$2 per day. According to a report released by the National Bureau of Statistics (NBS) in January 2012, the average annual income of China’s rural residents in 2011 was 6,977 yuan (about US$ 1,100, or about US$3 per day). Estimates of the annual incomes of China’s very poorest are much lower: in remote parts of the country as low as 1,500 yuan (about US$240, or about US$ .66 per day).

At the other end of the scale, the Hurun Rich List, an annual compilation of information about China’s richest people, said that in 2011, the average net worth of China’s 1,000 wealthiest people was around five billion yuan (US$924 million).

Bo Xilai’s son Bo Guagua’s tuition fees at Harvard were reported to be US$90,000 for his two-year program, while in 2009, the media reported the troubles of a man from Hubei province was having paying the tuition fees for his son at a local primary school after they were raised from 200 to 325 yuan. Though China has officially abolished tuition fees for students during the nine-year compulsory education period, schools still manage to find ways to collect money. The 325 yuan covered books, insurance and milk.

The minimum wage in Shanghai:

1,280 yuan per month.

The minimum wage in Shenzhen:

1,500 yuan per month.

The average monthly earnings in 2008 of Fu Yucheng, president of CNOOC (one of China’s large state-owned oil companies):

1.004 million yuan.

The most expensive houses in China, according to media reports cost eighty to ninety million yuan. In December 2010, a CCTV news report showed President Hu Jintao visiting subsidized housing in Beijing whose residents said they were paying seventy-seven yuan a month. The number became a meme on the Internet to mock CCTV’s propagandistic report: most urbanites, especially in large cities like Beijing, did not appear to know anyone with access to such cheap housing.

Of the indicators mentioned by Li Keqiang, bank lending is the most complex. Commercial bank lending accelerates with economic growth, while policy-driven bank lending is used counter-cyclically to bolster activity during a slow down. Although the amount of commercial bank lending is on the rise in China, most lending is still policy-driven, and it is a major instrument for stimulating economic growth. Scissors examines the official figures for growth rates of GDP and loans in China over the past decade and argues that the lending required to achieve below-average GDP growth in 2010 was worryingly high. He acknowledges that aggressive lending might have been appropriate for the weakening economy in 2008- 2009. But he contends that in 2010 this was a major policy mistake, with the ‘forced policy lending’ undoing a decade of banking sector reforms. With myriad worrying figures including official estimates of hidden local government debt at RMB10 trillion (US$1.5 trillion) and rising, and with Li Keqiang himself saying that bank lending is a key indicator of China’s economic health, Scissors’s analysis provides little room for optimism.

Nor does Carl Walter and Fraser Howie’s 2011 book titled Red Capitalism: The Fragile Financial Foundations of China’s Extraordinary Rise, which provides a detailed account of the complex maze that constitutes China’s state-owned banking and financial system. They extend the definition of ‘public debt’ to include not only the debt obligations of the central government and the Ministry of Finance (combined they are about twenty percent of GDP), but also of the four ‘policy banks’ and the Ministry of Railways, plus local government debt and even non-performing loans in state asset management companies, based on the argument that the central government would not allow any of these bodies to fail. This results in an estimate of ‘true public debt’ to GDP at 77.3 percent for 2011, well above the ‘red line’ international standard of sixty percent, and massively higher than twenty percent, the commonly reported figure that suggests that government finances are in good order. These findings are echoed in the IMF’s recent warning to China of the possible perils ahead in the country’s heavily state-controlled banking and financial system. Their report argues that ‘state controls over the economy were partly to blame for soaring property prices, excessive bank lending and mounting local government debt, and that these were among the growing risks that threatened to undermine the country’s economic boom.’

The skyscrapers and elevated ring roads that Beijing city planners dub the ‘Central Business District’ (CBD).

Source: Flickr/Trey Ratcliff

During recent years then it is little surprise that analysts in China have alleged that ‘the state advanced while the people are in retreat’ – that is, the state’s domination of the economy mitigates against further economic opening and reform. Whether or not this is as problematic as Walter and Howie and the IMF suggest depends very much on whether the numbers they have used in their analyses – most of which were drawn from official sources – are accurate or not. What exactly Li Keqiang meant by ‘for reference only’ is not clear – and it’s certainly not encouraging.

On top of banking and financial sector reforms, China faces an urgent need for reforms in public finance and government administration, according to Christine Wong, who reviewed China’s public investment infrastructure for the World Bank in 2011. Wong describes the proliferation of off-budget local investment corporations (LICs). Under the stimulus program of 2008-2010, these grew in number to more than 10,000 nationwide, with a total debt rising to RMB10 trillion by the end of 2010. With the banking sector’s limited capacity to appraise the credit-worthiness of LICs and even of local governments, whose finances are complex and non-transparent and for which little public information is available, Wong concludes that bailouts will be required for local governments and the Ministry of Railways. Such bailouts will divert resources away from the ‘harmonious society’ policies discussed in Chapter 3 of the present volume.

China’s Top Ten Richest

The Hurun Rich List, an annual compilation of information about China’s richest people, noted that in 2011 there were 271 US$ billionaires in China. It was called a ‘record year for China’s rich’.

The Rich List also notes that thirty percent of China’s top fifty richest people are delegates to the National Party Council or the Chinese People’s Political Consultative Conference. The top ten people (all men) on the 2011 list were:

- Liang Wengen 梁稳根

Wealth: US$11 billion

Age: 55

Company: Sany

Industry: Heavy machinery - Zong Qinghou 宗庆后 & family

Wealth: US$10.7 billion

Age: 66

Company: Wahaha

Industry: Soft drinks - Li Yanhong 李彦宏 (or Robin Li)

Wealth: US$8.8 billion

Age: 43

Company: Baidu

Industry: Internet - Yan Bin 严彬

Wealth: US$7.8 billion

Age: 57

Company: Ruoy Chai

Industry: Red Bull drinks, property, investments - Xu Jiayin 许家印

Wealth: US$7.2 billion

Age: 53

Company: Evergrande Property

Industry: Property - Wang Jianlin 王健林

Wealth: US$7.1 billion

Age: 57

Company: Wanda

Industry: Property - Wu Yajun 吴亚军 & family

Wealth: US$6.6 billion

Age: 47

Company: Longfor Properties

Industry: Property - Liu Yongxing 刘永行 & family

Wealth: US$6.4 billion

Age: 63

Company: East Hope

Industry: Aluminum, agricultural feed - He Xiangjian 何享健 & family

Wealth: US$6.3 billion

Age: 69

Company: Midea Group

Industry: Home appliances - Yang Huiyan 杨惠妍 & family

Wealth: US$5.6 billion

Age: 30

Company: Country Garden

Industry: Property

This sentiment is also reflected in the 2011 work of Xiaolu Wang and Wing Thye Woo. They have written on China’s ‘grey income’: not the income of an ageing population, but about the mis-reported household income particularly among the richest and most well-connected households. Their evidence shows that inequality in China is widening, despite the Communist Party’s recognition that social stability requires not just continuing high rates of economic growth but also the diffusion of the benefits of growth across society. In fact, they claim that the income of the wealthiest ten percent of Chinese households is not twenty–three times that of the poorest ten percent, as reported in the official data, but sixty-five times. Based on these findings, they conclude that:

Unless the government could stay largely uninfluenced by the rent-seeking lobbying of capital owners and other special interest groups, the free competition of the market economy would inevitably be replaced by the monopolistic practices of crony capitalism. Such a development would accentuate income inequality, economic inefficiency, and social conflict. To avoid these serious threats to economic development and social harmony, institutional reforms are essential, especially in the public finance system and government administrative system.

While the numbers behind this conclusion do not threaten imminent collapse, they are worth noting.

In the 2012-2013 transition period, a weakened European economy will substantially reduce the demand for Chinese goods in its largest export market. It is unclear just how much worse the global economic climate could become, or what China can do to prevent another crisis, if anything. They will have their hands full with domestic issues (as noted elsewhere in this volume). These range from the potential for social unrest as the gap between the haves and have-nots continues to widen, to dealing with ageing before affluence and the (possibly) fragile state of the country’s public banking and financial systems. The accurate reporting of the numbers that shape expert opinion and public perception both inside and outside China would help China considerably in facing this wide range of internal and external challenges.